Do secured credit cards help build your credit score?

Secured credit cards are excellent credit building opportunities. They allow you to boost your credit score and practice smart money habits without worrying about debt. Like any other credit card, you need to be mindful of the fees and expenses of secured cards. Let's take a closer look at secured card interest rates and what you can do to avoid them.

How Secured Cards Work

To understand how secured credit cards influence your credit score, you need to know how these cards work. With a standard credit card, the issuer provides a line of credit for the cardholder to use and repay. If the cardholder becomes delinquent or defaults on the debt, the issuer takes a financial loss.

With a secured credit card, you provide the funds for the line of credit. This happens in the form of a security deposit, usually ranging between $200 and $2,000. Some secured cards allow for higher balances, but most require a $200 deposit.

Each month, you will receive a bill reflecting the balance due on the card. This will be a combination of your transactions for the month, plus any fees you may have incurred. You can choose to pay off the balance or make the minimum monthly payment. The card issuer will then report your payments to the credit bureaus to help you build credit.

Your security deposit is not gone forever. You will get it back if you cancel the card or if you upgrade to an unsecured card in the future, as long as you have paid off your entire balance. If you default on your payments though, the issuer doesn't have any financial loss. That is why secured cards are easy to qualify for, regardless of your credit history. The credit card company can take on a 'high-risk' applicant because they are not the ones funding the line of credit.

Top Secured Credit Cards for Building Credit

If your goal is to boost your credit score, you need to choose the right card for your overall needs. Check out some of the best secured credit cards for credit building.

Oakstone Platinum Secured Mastercard®

The Oakstone Platinum Secured Mastercard® features a low APR of just 9.99%, along with a high credit limit and no penalty rate. Deposit anywhere from $200 to $5,000 onto the card, and immediately go to work building your credit score.

Assent Platinum 0% Intro Rate Mastercard Secured Credit Card

The Assent Platinum Mastercard Secured Credit Card features 0% APR for the first six months, which is practically unheard of for secured cards! The card supports deposits of up to $2,000, and has a convenient online platform for account monitoring.

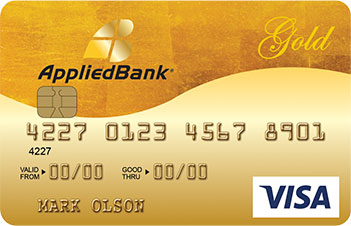

Applied Bank® Secured Visa® Gold Preferred® Credit Card

The Applied Bank® Secured Visa® Gold Preferred® Credit Card offers a low 9.99% fixed APR that won't increase even if you make a late payment. The card supports initial security deposits of up to $1,000, but that increases to $5,000 over time.

How a Secured Card Could Help Build Your Credit Score?

There are several ways having a secured card could help build your credit score. First, it's important to know which factors influence your credit score, and how much of an influence they have. Most lenders look to your FICO Score, which consists of these five factors:

- Payment History – 35%

- Credit Utilization – 30%

- Length of Credit History – 15%

- Diversity of Credit – 10%

- New Credit and Hard Inquiries – 10%

As you can see, payment history counts for the biggest portion of your credit score. If you make your payments on time each month, that will drastically improve your credit score over time.

Credit utilization refers to the amount of credit available vs. the amount of debt owed. If you have a $2,000 line of credit and you owe $500 on your secured credit card, your credit utilization rate is 25%. This number should stay below 30% for optimal credit building.

If you keep your secured credit card open for an extended length of time, that will build your length of credit history. This is true for other credit cards you may open in the future. Be mindful of annual fees and other costs for your credit cards. If you are paying a significant amount just to keep an account open, it may not be worth the minimal score improvement you receive.

Maintaining your secured credit card could open the door to other credit opportunities in the future, such as an auto loan, a home loan, or an unsecured credit card. If you develop a diverse credit portfolio, you once again can see an improvement in your credit score. Keep your hard inquiries to a minimum, and only apply for a line of credit when you're truly ready. These habits will give you the best chance at having good credit or excellent credit over time.

How a Secured Card Could Help Build Your Credit Score

Secured card payments get reported to the credit bureaus just like traditional credit card payments. If you make your payments on time, that positively impacts your credit score. If you miss payments, skip payments, or persistently make late payments, that will negatively impact your credit score.

So yes, it is possible for a secured credit card to hurt your credit score. Do not assume that you can miss a payment because you put down a security deposit. You need to treat your secured card like any other credit card, and you need to be mindful of your bill each month. As long as you can keep up with your payments, you can enjoy the benefits of secured cards without any drawbacks.

How to Use a Secured Credit Card to Build Credit

If you use your secured credit card wisely, you can progressively build credit and secure new lending opportunities. Here are some tips to get started:

- Use your secured credit card in place of cash or your bank debit card. Anything you would normally buy with cash or your debit card, use your secured card instead. Save the money you would have spent from those sources, and use it to pay off your balance every month. This will show consistent activity, and it will get you in the good habit of paying off your balance in full.

- Make your payments within the grace period. This will allow you to avoid interest, and it will ensure your payments are on time each month.

- Don't rack up debt you cannot repay. Even though you're technically borrowing your own money, you can't look at it like that. Until you cancel your card or upgrade to an unsecured card, you still need to pay off as much of your balance as you can possibly afford before the due date every month. Otherwise, you may hurt your credit score, negating the positive attributes of a secured credit card.

- Compare secured card offers. Not all secured cards are the same. Some have higher interest rates. Others have higher fees. Some may suit your lifestyle better than others. Explore your options to find the ideal secured card for you.

- Make a security deposit you can realistically afford. If that's only $200 to start out with, that's fine! You can always deposit more money when you have it available. The goal is to learn how to use your credit card wisely, without putting yourself in a financial bind.

- Keep your carryover debt low. If you're going to carry a balance into next month, keep it as low as possible. Maybe you can't pay off your full balance, but you can pay half of it. Contribute as much as you can toward the principal to lower your interest and keep your credit utilization down.

- Beware of the fees on your secured credit card. Every card has different types of fees and different fee amounts. There are many ways to work around these fees, but you can't avoid them if you don't know what they are.

- Lather, rinse, repeat. Maintain the habit of using your card and paying off your balance every single month. The longer you keep this going, the better your chances are of building credit with a secured credit card.